Hello TAG team!

First and foremost, thank you for such a thoroughgoing report that reviews the current challenges facing the CFG token, as well as a number of suggestions for how to remedy said challenges. While I’m sure I might be able to share more at our next governance call after further reflection, I wanted to at least share some initial thoughts based on the major categories outlined in the executive summary.

Community Expansion:

In my mind–and admittedly I am quite biased considering many see me as a “community guy”–I believe this is the easiest goal to achieve. During my one-on-one call with Jana, I shared a number of ideas about how key partnerships might broaden the awareness of the Centrifuge ecosystem among more retail oriented investors. Granted, while I understand that Centrifuge’s main audience would be larger institutional clients, the best way to expand community is by growing the awareness of Centrifuge among average folks like me.

Why? Because smaller investors like me who have a growing audience on X (formerly Twitter) provide a service by networking with their friends. Considering how hot the RWA narrative is right now, getting more accounts on X (especially high quality KOLs I know and would like to recommend) to educate others about what Centrifuge is building could broaden the base of the community and help cement Centrifuge’s legacy status about RWA protocols in Web3.

I had been chatting about this topic in particular with @ImdioR for the last few months, even suggesting a few ideas about how we can make this happen (which I also passed along to Jana). Hopefully the Centrifuge DAO grant program can usher in a new era with content creators and educators leading the way to help spread the news about Centrifuge and encourage others to join the community.

Supply Management:

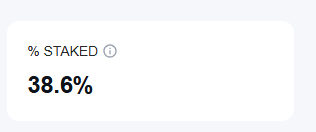

I really like the idea of governance staking, because it is akin to what we use already via Polkadot governance insofar as those who are willing to lock up their tokens receive a greater share of voting power. I believe another interesting idea in this regard is something that Hydration does, which is those who lock up their tokens for governance get a staking boost. Granted, CFG has never had staking or staking rewards in the past, but if some small portion of fee generation could be shared with those who lock their tokens for governance for participation it may also help with supply management.

Liquidity Enhancement:

It would seem this could easily be handled via greater proliferation of the Centrifuge token on more exchanges, seeding liquidity pools on decentralized exchanges, as well as working with reputable market makers. I’d assume that @theoyster would have many connections in this industry considering his line of work and the relationships he has undoubtedly cultivated over the course of his career in Web3.

Revenue Sustainability:

It would seem there are a number of ways to create a revenue flywheel for Centrifuge: 1) teams permissionlessly launching deRWAs on V3 either must pay an upfront cost in CFG or, better yet, mint them for free by then CFG is earned on the margins by providing a deRWA dex that facilitates the trading of these novel tokens; 2) if such infrastructure were to be built, CFG could be the gas token for this deRWA dex and those gas fees could be sent to the treasury…alternatively, if the fees were captured in ETH or some other digital asset, that could be used to buy back CFG tokens. Not exactly revenue per se, but it would put buy pressure on the token and help grow the value of the treasury itself.

I realize these are only initial suggestions and may be half-baked. I will continue to think about them more and share additional ideas at our next governance call when we will likely discuss this report at length.

Thanks again for leading the way in this dialogue, TAG!

Gratefully,

Ryan / Phunky

![]()